Year in Review

From community events to improved member experience, see what your favorite credit union was up to in 2025.

TODAY’S RATES

BOOST TO EVERYDAY SAVINGS¹

offered on Primary Share Savings

3.56%

On the first $1,000.

Home Equity

Loans ²

fixed rate as low as

7.146%

for a 20-year closed-end home equity loan.

Business Auto

Loans ³

as low as

6.49%

for a new vehicle with less than 12,000 miles with a term up to 60 months.

Save Big, Earn Big! Now offering more dividends on higher balances, for select share certificates. Learn More »

SESLOC Members

can save up to

$202

at Gymnazo

can save up to

$202

at Gymnazo

Offer ends January 31, 2026. Terms, conditions, restrictions and eligibility apply.

Say Hello to Your New Level Up Dashboard

Wondering how many Level Up points you’ve earned? We took out the guesswork. Check out your new dashboard in Online Banking to see your points and benefits in our easy-to-read charts.

Say Hello to Your New Level Up Dashboard

Wondering how many Level Up points you’ve earned? We took out the guesswork. Check out your new dashboard in Online Banking to see your points and benefits in our easy-to-read charts.

- Protect Yourself From Scams -

Explore the

SESLOC Fraud Center

Current incidents affecting SESLOC Membership:

MEMBER ADVISORY: Phone Spoofing Scam Targeting SESLOC Members From Phone Teller Number

SESLOC members have reported receiving fraudulent phone calls from scammers claiming to be from the credit union and using our phone number in the caller ID. These calls are fake – please do not give a caller any information, hang up immediately.

Setting up a

Direct Deposit

is now even easier!

Quickly establish or move your paycheck or other direct deposit to SESLOC in just a few clicks in Online Banking—no need to contact your employer.

Celebrating the People

Who Make the Central Coast the Best Place to Live

SESLOC Cares for Community Award

In partnership with NewsChannel 12, each month we select one nonprofit to nominate a volunteer who goes above and beyond to give back to their community.

Dayna Debernardi Watson Earns SESLOC Cares for Community Award for Decades of Service to Youth Causes

We’re partnering with News Channel 12 to honor nonprofit volunteers who make our community thrive....

SESLOC Young Change Makers Award

In partnership with Wild 106.1, each month we honor a young resident who volunteers or uses their entrepreneurial spirit to drive change.

Nick Firestone Named SESLOC Young Change Maker for Environmental Sustainability and Strong Community Ties

SESLOC Credit Union is proud to honor Nick Firestone as a SESLOC Young Change Maker. Nick recently earned...

Celebrating the People

Who Make the Central Coast the Best Place to Live

SESLOC Cares for Community Award

In partnership with NewsChannel 12, each month we select one nonprofit to nominate a volunteer who goes above and beyond to give back to their community.

Dayna Debernardi Watson Earns SESLOC Cares for Community Award for Decades of Service to Youth Causes

We’re partnering with News Channel 12 to honor nonprofit volunteers who make our community thrive....

SESLOC Young Change Makers Award

In partnership with Wild 106.1, each month we honor a young resident who volunteers or uses their entrepreneurial spirit to drive change.

Nick Firestone Named SESLOC Young Change Maker for Environmental Sustainability and Strong Community Ties

SESLOC Credit Union is proud to honor Nick Firestone as a SESLOC Young Change Maker. Nick recently earned...

Life happens.

SESLOC Instant Funds loans are here to help.

With a Life Event or Smart Payday Loan, you could get funded in less than 60 seconds, even on nights and weekends. (Terms and conditions apply, click “Learn More” for complete details.)

Drive Your Business Forward

Basic Business Vehicle Loans are now more affordable.

A must-have for all Mustangs.

Introducing the all new Cal Poly Debit Rewards Card for HomeFREE Checking™

Same benefits. Same rewards.

But now, pay with Cal Poly pride.

The best place to bank

is not a bank.

It's here. At SESLOC.

Take it To Go

For an optimal Online Banking experience, download the SESLOC mobile app.

SESLOC Business Services

Local. Stable. Flexible.

Get Buying Power

It’s time to purchase your Central Coast dream home.

Featured Stories from SESLOC News+

Our latest events, community stories and tips to boost your financial IQ

Ring in 2026 With These Seven NEW Local Rewards Businesses

Just in time for 2026, even more Local Rewards businesses have teamed up with SESLOC, earning you more points for your everyday shopping.

Stay Smart from Social Security Scams

How can you determine a real communication from the Social Security Administration? Here’s what to watch for Social Security scams.

How to Set Homeownership Savings Goals

When you’re thinking about a new home, it all starts with creating a realistic savings plan to work towards it.

Happening Now at SESLOC

Join us for these upcoming member education opportunties, events and celebrations.

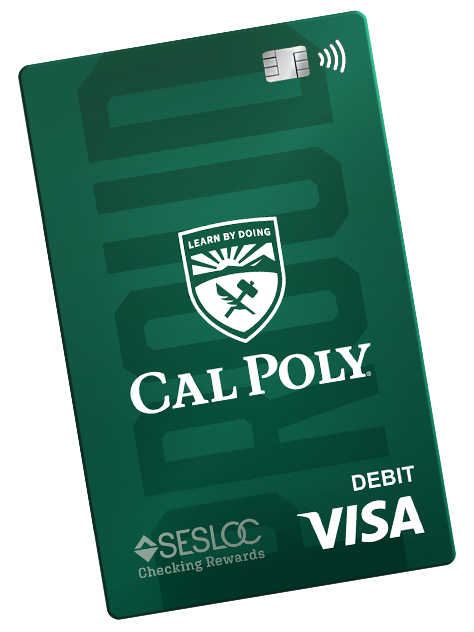

Financial Webinars

Free and open to the public

This presentation helps participants understand how to prepare financially for life’s unexpected events, such as job loss, medical expenses, or emergency repairs. Attendees will learn why emergency savings matter, how much to aim for, where to keep their funds, and practical ways to start building savings, even on a tight budget. The session also explores additional financial safety nets, including insurance and workplace benefits, empowering individuals to reduce financial stress and make confident decisions when the unexpected happens.

Webinars From the Vault: Auto Buying Made Easy

Watch online

In Auto Buying Made Easy, we talk about what to know before you head to the dealership. Presented June 11, 2025. Presented by Vincent Delgado, Education Outreach Manager.

Events & Celebrations

Holiday Closures

Branches, Contact Center and Live Chat are closed in observance of upcoming federal holidays. See all closures.