When it comes to buying a house, poor credit can limit your opportunities and result in higher interest rates and bigger payments.

But with a little planning, you can boost your credit score ahead of your home loan pre-approval so you’ll be ready to make an offer on your dream home.

Understanding Your Credit Score

A lot of people feel mystified by their Credit Score (aka FICO Score), but it’s actually a calculation based on your activity in a few categories that assesses the likelihood that you will repay any debt you owe.

It’s also important to understand that there isn’t just one score — there are three major credit-reporting bureaus: Experian, TransUnion, and Equifax.

Your score will vary depending on which agency you’re looking at because there are slight differences in their calculations.

However, the factors that impact your score are the same, and understanding them is the first step to building great credit.

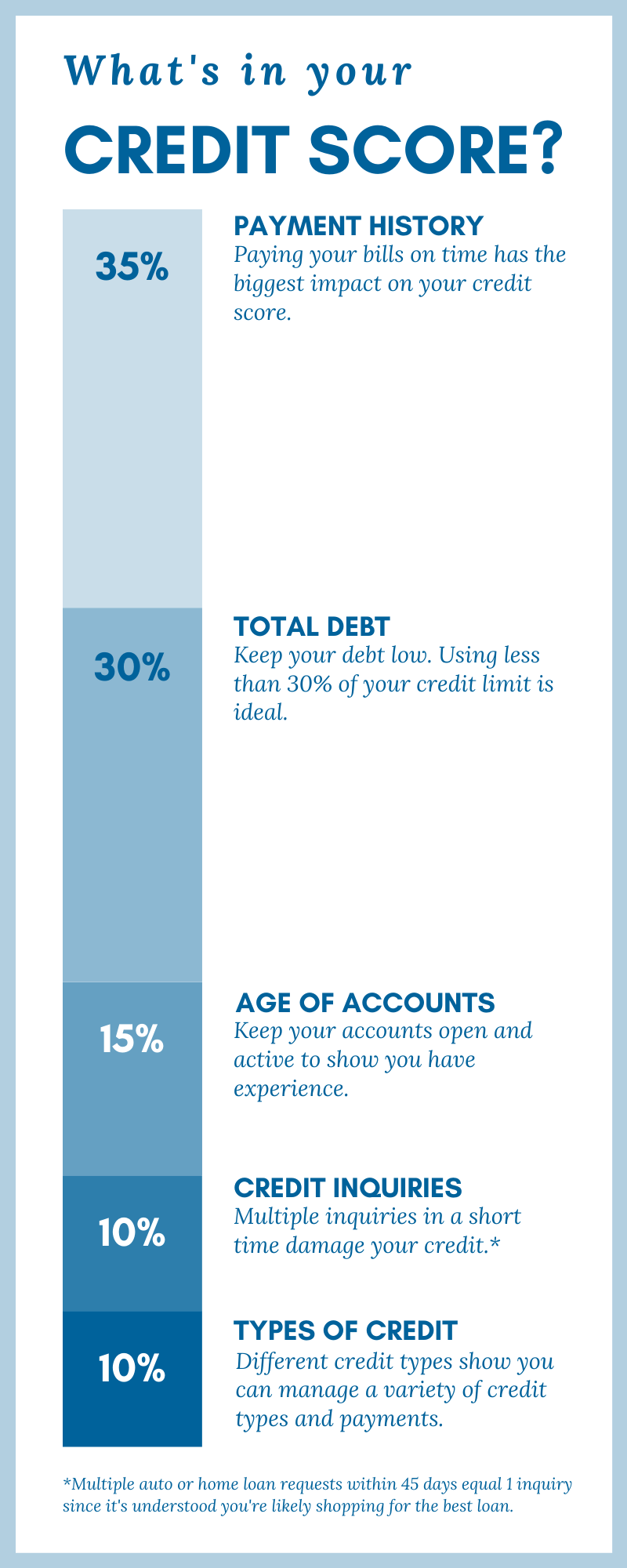

« Check out this infograph to see what makes up your credit score.

Four Strategies for Boosting Your Credit Score

- Set up automatic payments. Payment history has the biggest impact on your credit score, so automatic payments just make sense. SESLOC offers free Bill Pay so you can ensure bills are paid on time and that you never miss a payment.

- Correct errors on your credit report. Statistics show that 70% of all credit reports contain at least one error, whether it’s due to identity theft or a simple clerical error. Review your free annual credit report for accuracy, and report any errors in writing to the credit bureau (Experian, Equifax, and/or TransUnion). Learn how.

- Get insights with Financial Wellness Tools. SESLOC Financial Wellness tools in Online Banking includes credit score monitoring and insights into your credit report. Powered by SavvyMoney, our tool pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0.*

- Maintain your credit utilization. You might be considering closing your credit cards after you pay them off, but keep in mind that your credit utilization and length of credit history plays a part in your score. Keep your card with the longest history, and aim to use no more than 30% of your credit limit.

The workers are sooo nice and friendly!!"

The workers are sooo nice and friendly!!"